Ontbijtseminar Actualiteiten Arbeidsrecht op 18 april 2024

Wederom organiseren wij een ontbijtseminar, waarbij u onder het genot van een goed verzorgd ontbijt, wordt bijgepraat over de laatste ...

Wederom organiseren wij een ontbijtseminar, waarbij u onder het genot van een goed verzorgd ontbijt, wordt bijgepraat over de laatste ...

Op 10 mei 2023 zijn er nieuwe Europese regels vastgesteld om ervoor te zorgen dat mannen en vrouwen evenveel gaan ...

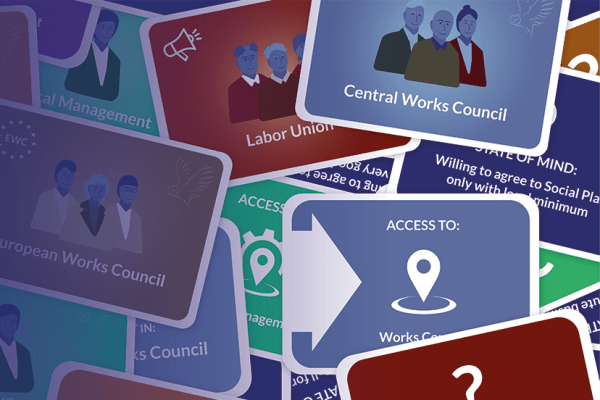

Speel de unieke Pallas Advocaten OR-Game Als OR-lid ben je vaak bezig met adviestrajecten, maar hoe ga je in de ...

Pieter de Ruiter en Michelle Maaijen van Pallas Advocaten hebben vakbond AVV en de vrachtvliegers met succes bijgestaan in het kort ...

Recent interviewde Wim van Santbrink Steven Jellinghaus tijdens een podcast. Dit naar aanleiding van het onlangs verschenen naleving WOR onderzoek. ...

Webinar HR Quarterly Update, a periodical employment law update for professionals who operate in an international working environment and who ...